Publications

Reports

Clean Energy Potential in Southland Cook County

Rooftop Solar and Energy Efficiency Opportunities in Southland Cook County, IL

August 01, 2024

To help the Chicago suburban region achieve their clean energy goals as a means to realizing

equitable and sustainable outcomes, ELEVATE has been working with the five municipalities. To

develop comprehensive plans, quantitative data about their energy, climate, health, and

economy are necessary.

However, the five municipalities have very little data to work from and

need both to understand their current situation and how the community could develop in the

future. To promote the climate prioritization efforts, Greenlink was engaged in the data

collection and analytics providing information about existing community electricity usage, clean

energy potentials, emissions benefits, job creation potentials, the distribution of various

economic, social, and health-associated burdens.

Impacts of Energy Burden for Jacksonville

Energy Burden Impacts: Florida in Focus

March 2023

On average, households nationally pay about 4.1% of their income on energy (gas and electricity) bills. As of 2019, Jacksonville’s average energy burden is 4.3% in 2019, .2% higher than the national average. However, the energy burden is not distributed evenly across neighborhoods. When energy burden is mapped across the city, data shows that it disproportionately impacts residents in the Northern and Central portions of the city.

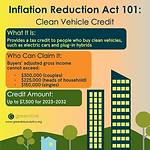

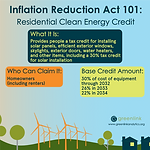

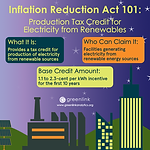

Infographics

.png)

Inflation Reduction Act: Tax Credits

July 2023

Greenlink Analytics explores credits made available to both consumer and commercial taxpayers under the Inflation Reduction Act of 2022